How landlords can be a step ahead of the 2027 income tax increase

For professional landlords, the 2027 income tax increase is not just another line in the Budget.

It's a signal that how property income is structured, extracted and protected matters more than ever.

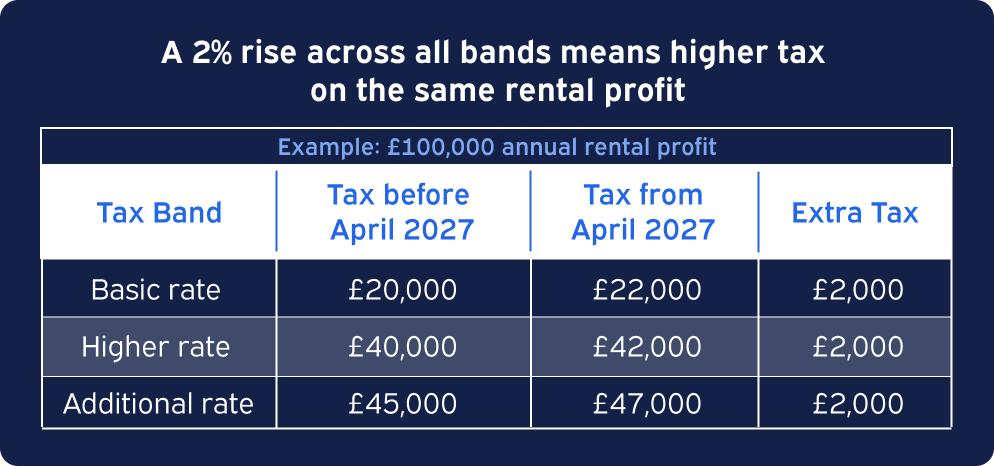

Over the last decade, tax pressure on rental income has steadily increased. From April 2027, that pressure increases again, with property income tax rates rising by 2 percentage points across all bands.

For landlords operating through limited companies or SPVs, this change can expose weaknesses that may have gone unnoticed for years.

Why 2027 matters for SPV landlords

A 2 percent increase in tax may not sound dramatic on its own. But when combined with frozen tax thresholds, restricted mortgage interest relief and rising compliance costs, the impact on post tax profit becomes far more noticeable.

For many SPV landlords, the issue is not just how much tax is paid. It’s how profits are extracted from the business and what happens if income is disrupted.

What worked when margins were wider doesn’t always work in a tighter, more regulated environment.

The questions landlords are already asking

As pressure builds, landlords are stepping back and asking different questions:

1. Am I extracting profits from my SPV in the most tax-efficient way?

2. What happens if I cannot work or manage the portfolio?

3. Is my property income protected if circumstances change?

4. Am I planning long term or just reacting year by year?

These are not just tax questions. They are key to understanding your level of risk.

Why protection is now part of profit planning

Many landlords still view protection as an optional extra. In reality, for company and SPV landlords, protection often plays a much bigger role in how profits are preserved and extracted.

Well structured planning can help protect income without increasing personal tax, support business continuity and reduce the risk of forced decisions if circumstances change.

The landlords who review this early tend to have more flexibility and more control when rules tighten.

Being a step ahead does not mean drastic action

Getting ahead of the 2027 income tax increase does not mean restructuring portfolios overnight. For most landlords, it starts with clarity:

- Understanding where tax pressure is increasing

- Knowing how profits are currently extracted

- Identifying where income is exposed

- Reviewing whether the current setup still supports long term goals

That clarity creates options.

Looking ahead, not just reacting

The 2027 income tax increase is already legislated. What remains undecided is how prepared landlords will be when it arrives.

For SPV and company landlords, the difference will not be the headline tax rate, but the quality of the planning behind it. Those who understand how income flows, where pressure builds and what happens when circumstances change tend to make calmer, better-timed decisions.

Being a step ahead is not about predicting every rule change. It is about making sure your structure still works when margins tighten, tax rises and flexibility matters more.

For landlords who take the time to review this now, 2027 becomes a managed adjustment rather than an unwelcome surprise.